Targeting the paper industry

Targeting the paper industry

PAPER mills can substantially reduce their water consumption if they were charged a higher price for the water they use, says a detailed water audit conducted by the Bureau of Industrial Costs and Prices (BICP).

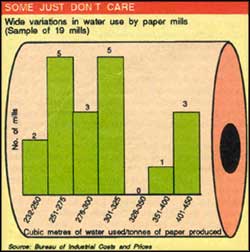

In 1989, the pulp and paper industry had an annual installed capacity of 3.354 million tonnes and its total water requirement for paper production was estimated at 805 million cubic metres (cum). The bureau found the water demand of various mills ranged from 130 cum to 450 cum per tonne of paper produced. And, on an average, the effluent generated was 275 cum/tonne of paper produced.

Most paper mills get their water from rivers, some mills also use groundwater. The cost of the water used by them ranged from 40 paise/cum to Rs 1.01/cum. Thus, the cost of water per tonne of paper produced varied from Rs 84 to Rs 360 -- 0.84 per cent to 3.6 per cent of the cost of a tonne of paper.

As against the average water demand of around 300 cum/tonne of paper by Indian mills, the average water demand of paper mills in the US is only 142 cum/tonne of paper. A record reduction in effluent discharge was achieved by the Kraft mill in the US when its effluents dropped from 90.8 cum/tonne of paper in 1900 to 22.7 cum in 1982. Some Canadian and Swedish mills have achieved almost zero discharge, which means they recycle almost all their effluents.

The wide variation in the water consumption of Indian mills can be only partially explained by their outmoded machinery and use of cellulosic materials such as bamboo, bagasse and straw, instead of softwoods as in Europe and North America. The BICP report says, "Water consumption patterns and effluent discharges of Indian mills vary very substantially from mill to mill. While using the same furnish (??), process and equipment, there should not be such a variation. It appears that Indian mills are not yet fully conscious about water consumption/effluent discharges."

The BICP study contends the price of water is too cheap for paper mills to economise on its use. The maximum reported cost of raw water for paper mills at 96 paise/cum is much below, for example, the Rs 9.40/cum water charge levied on industrial users in Madras. Indian water rates are also lower than those of many other developing countries.

The study points out that 80 per cent of the paper and pulp units consume less than 325 cum/tonne of paper, while 47 per cent use less than 300 cum/tonne. It, therefore, recommends that freshwater consumption by paper mills be restricted to 325 cum/tonne of paper produced and higher consumption be taxed at a progressively higher rate or penalised.

Low rates

The report also argues that the water cess levied by the Central and state pollution control boards -- from 75 to 2.5 paise per cum of water used -- is too low to have any impact on water use. It only helps to augment the financial resources of the pollution control boards. Even if the cess is raised to a flat Re 1/cum, the cost of a tonne of paper will go up only by 3 per cent.

The report contends raising the cess to a minimum level of 50 paise/cum will create an awareness that water is not a free resource and its impact of an additional 1.5 per cent on production costs will encourage water conservation measures.

The study, therefore, recommends water cess be raised to a minimum of Rs 1.30/cum for paper manufacturers, with a rebate of 80 paise for mills that set up a treatment plant. The revenue thus collected can be used to subsidise water conservation efforts. After a grace period of a year, paper mills using more than 325 cum/tonne of paper could be charged a cess at a higher rate of Rs 1.80/cum for every cubic metre of water used in excess.

| FAR TOO CHEAP | |

| Water rates for industrial users in some Indian cities as compared with the average rates in other countries (in Rupees per cubic metre) | |

| Madras Bombay Kandla Hyderabad Patalganga Porbandar Balsad Baroda Khopoli Ahmednagar |

9.44 9.02 7.00 5.00 4.73 4.00 3.22 2.80 1.83 1.62 |

| Other countries | |

| Yemen Arab Republic Nigeria Liberia Tanzania Senegal Bangladesh |

22.43 10.72 7.04 3.84 3.52 0.90 |

| Source: Bureau of Industrial Costs and Prices | |