Manmohan's bag of magical budgeting tricks

Manmohan's bag of magical budgeting tricks

"THE SENSE of crisis is behind us," proclaimed Manmohan Singh, presenting the annual Union budget -- his third -- in Parliament. The clarion call of confidence with which Singh put forth his intention to liberalise and globalise the Indian economy confounded both supporters and detractors.

Indeed, the finance minister seemed to conjure up the impossible: not only did he offer concessions worth Rs 4,522 crore through changes in customs and excise duties, he also increased planned expenditure by more than one-third of what it was in 1992-93. It was as if the infamous resource crunch, blamed by experts and laypersons as the bane of the Indian economy, was non-existent.

In his budget address, Singh explained the increased expenditure was made possible by "working ceaselessly to overcome the very difficult economic situation that we inherited" -- not missing once again the opportunity to remind one and all that the economy in June 1991, when he took office, was a mess.

Singh assured Parliament he intends to continue the recovery into the next year through "priorities for economic policy at this critical stage of economic restructuring": reduction of fiscal deficits, conversion of the "hesitant economic recovery" to a strong revival and exports as a "high-priority national endeavour".

Many expert observers already see the success of Singh"s policies. Veteran journalist Prem Shankar Jha, an economic policy advisor to political parties, says liberalisation and fiscal discipline have enabled Singh to fashion a budget so it combines "large-scale increases in expenditure on the poor, even as we develop strengths to compete with the global economy".

Others who rate the new budget highly stress the 62 per cent increase in capital outlay next year for rural development. They assert the 20-30 per cent reduction in customs duties on most industrial products -- especially capital goods -- will insert high quality as a permanent feature of the Indian economy.

But critics differ with Singh on all counts. Satish Jain of Jawaharlal Nehru University in Delhi argues the claims of financial discipline "conveniently overlook the fact that borrowings -- both internal and external -- continue to be an important source of capital for the government." In fact, says Jain, "This budget is actually an exercise in profligacy, as it depends crucially on a 15-per cent increase in public borrowing by the government, from Rs 5,300 crore in 1992-93 to Rs 6,000 crore."

Surendra Mohan, a Janata Dal MP with socialist leanings, contends most of the reductions in excise duties are on items produced for the rich. Reducing excise duty on these items, he says, will give the government less money to spend on welfare programmes for the poor. This is evidenced, Mohan contends, from the drastic drop in food and fertiliser subsidies.

Environmentalists are apprehensive that increased production of industrial goods will be at the cost of the environment. When shown explicit "environmental provisions" in the 1993-94 budget and asked if this was not proof of Singh"s ecological concern, Kanchan Chopra of the Institute of Economic Growth in Delhi emphasised the need "to see where the overall strategy of globalisation and liberalisation of the economy is leading the country"s environment.

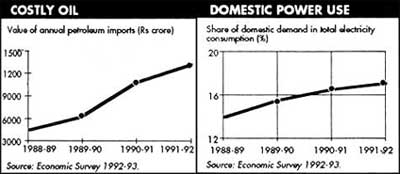

Others predict the new budget will cause a rash spurt in the energy consumption of the rich and corresponding increases in middle-class demands for electric appliances. Jyoti Parikh of the Indira Gandhi Institute of Development Research in Bombay, argued that with 10 per cent of the population consuming about 90 per cent of available energy, even a small accrual in their energy demand would result in a heavy overload.

| UNEVEN INCREASES | |

| Changes in outlays in 1993-94 budget from 1992-93 budget (in percentage) | |

| Total expenditure (Plan and non-plan) |

+5.28% |

| Plan expenditure (Central and state outlays) |

+11.5% |

| Central outlay | +32.08% |

| Source: Union Budget | |

| THE LAO OF LUXURY | ||||||

| Excise revenue from middle-class consumption (Rs crore) | ||||||

| Year | ACs & Fridges | Motor Cars | Colour TVs & VCRs | |||

| Estimated | Actual | Estimated | Actual | Estimated | Actual | |

| 1991-92 1992-93 1993-94 |

305.42 339.77 275.00 |

270.67 266.10 - |

699 800 750 |

778.64 702.17 - |

263.43 264.00 225.00 |

232.2 215.6 - |

| Source: Union Budget | ||||||

Boosting industry will tax resources base

Budgetary provisions aimed at giving a fillip to industry, will add to the burden on the country"s resources.

CONSUMER-led growth that the finance minister is pushing in the new budget is arousing fears of an intolerable burden on natural resources through provisions such as allowing cheaper exports of iron ore and granite and promoting industrialisation in Himalayan states and deep-sea islands by offering a five-year tax holiday.

The withdrawal of the export duty on unpolished granite and iron ore received a mixed reaction in the Union ministry of mines. Some officials see the levy withdrawals as an unhealthy sign of "allowing an outflow of crude minerals without value addition" and of "a licence to harm the environment".

Divakar Dev, joint secretary in the mining ministry, contends, "The new mining policy has provided for adequate environmental safeguards" and K P S Nyati of the Confederation of Indian Industries (CII) adds, "The budget will make coal-mining projects and equipment cheaper. On the one hand, this means more investment in this sector; on the other, it means coal-mining projects will have funds for environmental protection."